Aggressive Advocates.

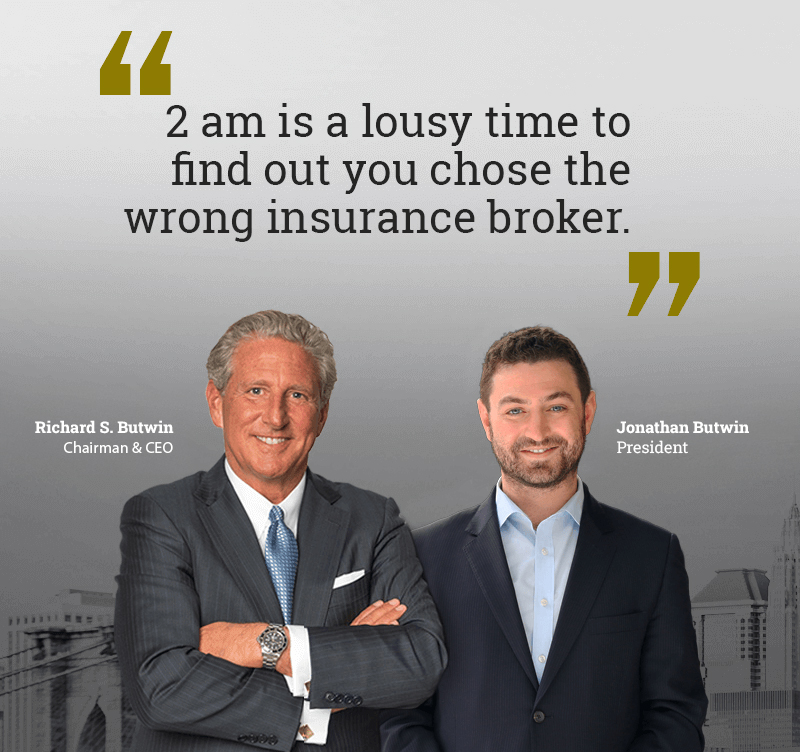

We are Butwin Insurance Group, a dynamic 100-year-old property and casualty, risk management, life and benefits insurance broker servicing over 10,000 clients.

Specializing in medium-to-large personally held corporations and high net-worth individuals, our clients are successful companies and individuals. We know that their businesses and estates are unlike any other, and are mindful that all their assets and future earnings may be at stake.

We admit to being aggressive. We could not have gained our success without asserting ourselves. Our clients don’t object.

While we draw on our historic strengths, we’re quick to abandon comfortable routines when problems or opportunities require fresh thinking. We create unique solutions. We provide inspiring, drop everything service. It’s why so many of our clients view us as a valued member of their financial inner circle.

Welcome to Butwin Insurance

In-Demand Insurance Solutions

Disgruntled Employees. Expensive Consequences.

Failure to hire, failure to promote, wrongful termination, discrimination, sexual harassment, discomfort from improper e-mails, and office jokes are just some of the lawsuits brought against employers. While maybe 80% of these allegations are groundless, the defense costs can be large and they are often settled for some amount.

So Much Exposure. So Easy to Protect.

With unfortunate regularity you hear about companies disclosing they are the latest victims of massive credit card or personally identifiable information (PII) theft. These are companies with the most expensive and elaborate controls in place. What you don’t hear about are the countless other breaches that go on every day to regular companies like yours. 63% of all losses are to firms with less than 100 employees! It is everywhere and it is not just about credit cards!

Protect Yourself and Your Personal Assets

In an increasingly litigious business environment, professional liability insurance, often called errors and omissions liability insurance or malpractice insurance, is a necessary component of any business owners’ risk management plan.

Peace-of-Mind Protection

At Butwin Insurance Group, we understand what it takes to protect one-of-a-kind, highly valued home features and fixtures – and to deliver the peace of mind that you are well protected should the unexpected happen.

NYS Sexual Harassment Prevention

For the benefit of our valued Butwin clients, we have provided easy access to the materials necessary to support the implementation of this new law into your business. We’ve set up a special section of our Website to provide training presentations, sample policies, posters, and more – approved by New York State Department of Labor – all in one convenient location.

What Our Clients Are Saying

CEO of World Travel Holdings

GM of Pine Hollow Country Club

CEO of The Tiffen Company

President of Win-Holt

Experts in Meeting the Unique Insurance Needs of Financial Services Firms

Our close proximity to the largest financial district in the world and a keen understanding of the risks inherent to financial services firms has helped Butwin Insurance Group build a unique expertise in meeting very specialized insurance needs:

By Type of Firm

Asset Managers

Hedge Funds

Broker—Dealers

Private Equity Funds

Other

By Specific Product

Directors and Officers Insurance

Fiduciary Liability Insurance

ERISA

Cyber Liability Insurance

Fund Liability Insurance

Errors and Omissions Insurance

Lender Liability Insurance

Fidelity Bond / Crime Insurance

Employment Practices Liability Insurance

Learn more about insurance products for financial services firms

Small Business: Critical Coverages With a Convenient, Cost-Effective Solution

A business owner’s policy (BOP) is a commercial insurance policy designed especially for small-and medium-sized businesses. They provide lower premiums and ease of purchase by bundling basic coverages into a single easy-rate policy. A typical BOP includes property, liability, business interruption, and crime coverages.

Butwin can tailor a BOP to meet your specific business needs:

Retail Stores

Consumer Services

Food Service

Professional Offices

Contractors

Medical Practices

Custom BOP

Preferred Agents. Priority Access. More Competitive Pricing.

We represent almost every major insurance carrier, most of whom consider us a preferred agent. This means we have priority access to new products, the finest underwriters, better pricing, and preferential treatment in the event of limited capacity.

Agency Billed

Agency Billed